How to Transfer Money From Stripe to Bank Account

This guide walks you through how to add funds to your account balance and transfer the funds into your users' bank accounts, without processing payments through Stripe. This guide uses an example of a Q&A product that pays its writers a portion of the advertising revenue that their answers generate.

To add funds to your account balance, your platform must be on a manual payout schedule. You can configure your schedule in your payout settings.

Prerequisites

- Register your platform.

- Add business details to activate your account.

- Complete your platform profile.

- Customize brand settings. Adding a business name, icon, and brand color is required for Connect Onboarding.

Install Stripe's official libraries so you can access the API from your application:

# Available as a gem sudo gem install stripe

# If you use bundler, you can add this line to your Gemfile gem 'stripe'

When a user (seller or service provider) signs up on your platform, create a user Account (referred to as a connected account) so you can accept payments and move funds to their bank account. Connected accounts represent your users in Stripe's API and facilitate the collection of information requirements so Stripe can verify the user's identity. For a Q&A product that pays for answers, the connected account represents the writer.

Step 2.1: Customize your signup form

In your platform settings, customize your Express signup form by changing the color and logos that users see when they click your Connect link.

Step 2.2: Create an Express account

Use the /v1/accounts API to create an Express account and set type to express in the account creation request.

curl https://api.stripe.com/v1/accounts \ -u: \ -d type=expresssk_test_4eC39HqLyjWDarjtT1zdp7dc

If you've already collected information for your connected accounts, you can prefill that information on the account object for the user and it won't be collected again in the Connect Onboarding flow. Any information on the account can be prefilled, including company or individual information, external account information, and more.

Step 2.3: Create an account link

Create an Account Link with the following arguments:

-

account -

refresh_url -

return_url -

type=account_onboarding

curl https://api.stripe.com/v1/account_links \ -u: \ -d account=acct_1032D82eZvKYlo2C \ -d refresh_url="https://example.com/reauth" \ -d return_url="https://example.com/return" \ -d type=account_onboardingsk_test_4eC39HqLyjWDarjtT1zdp7dc

Step 2.4: Redirect your user to the account link

The response to your Account Links request includes a value for the key url. Redirect your user to this link. URLs from the Account Links API are temporary and can be used only once because they grant access to the account holder's personal information. Authenticate the user in your application before redirecting them to this URL. If you want to prefill information, you must do so before generating the account link. After you create the account link for an Express account, you won't be able to read or write information for the account.

Don't email, text, or otherwise send account link URLs directly to your user. Instead, redirect the authenticated user to the account link URL from within your platform's application.

Step 2.5: Handle the user returning to your platform

Connect Onboarding requires you to pass both a return_url and refresh_url to handle all cases where the user is redirected to your platform. It's important that you implement these correctly to provide the best experience for your user.

You can use HTTP for your return_url and refresh_url while in test mode (e.g., to test with localhost), but in live mode only HTTPS is accepted. Be sure to update testing URLs to HTTPS URLs before going live.

return_url

Stripe issues a redirect to this URL when the user completes the Connect Onboarding flow. This doesn't mean that all information has been collected or that there are no outstanding requirements on the account. This only means the flow was entered and exited properly.

No state is passed through this URL. After a user is redirected to your return_url, check the state of the details_submitted parameter on their account by doing either of the following:

- Listening to

account.updatedevents. - Calling the Accounts API and inspecting the returned object.

refresh_url

Your user is redirected to the refresh_url when:

- The link has expired (a few minutes have passed since the link was created).

- The link was already visited (the user refreshed the page or clicked back or forward in their browser).

- Your platform is no longer able to access the account.

- The account has been rejected.

The refresh_url should call Account Links again on your server with the same parameters and redirect the user to the Connect Onboarding flow to create a seamless experience.

Step 2.6: Handle users that haven't completed onboarding

A user that's redirected to your return_url might not have completed the onboarding process. Use the /v1/accounts endpoint to retrieve the user's account and check for charges_enabled. If the account is not fully onboarded, provide UI prompts to allow the user to continue onboarding later. The user can complete their account activation through a new account link (generated by your integration). You can check the state of the details_submitted parameter on their account to see if they've completed the onboarding process.

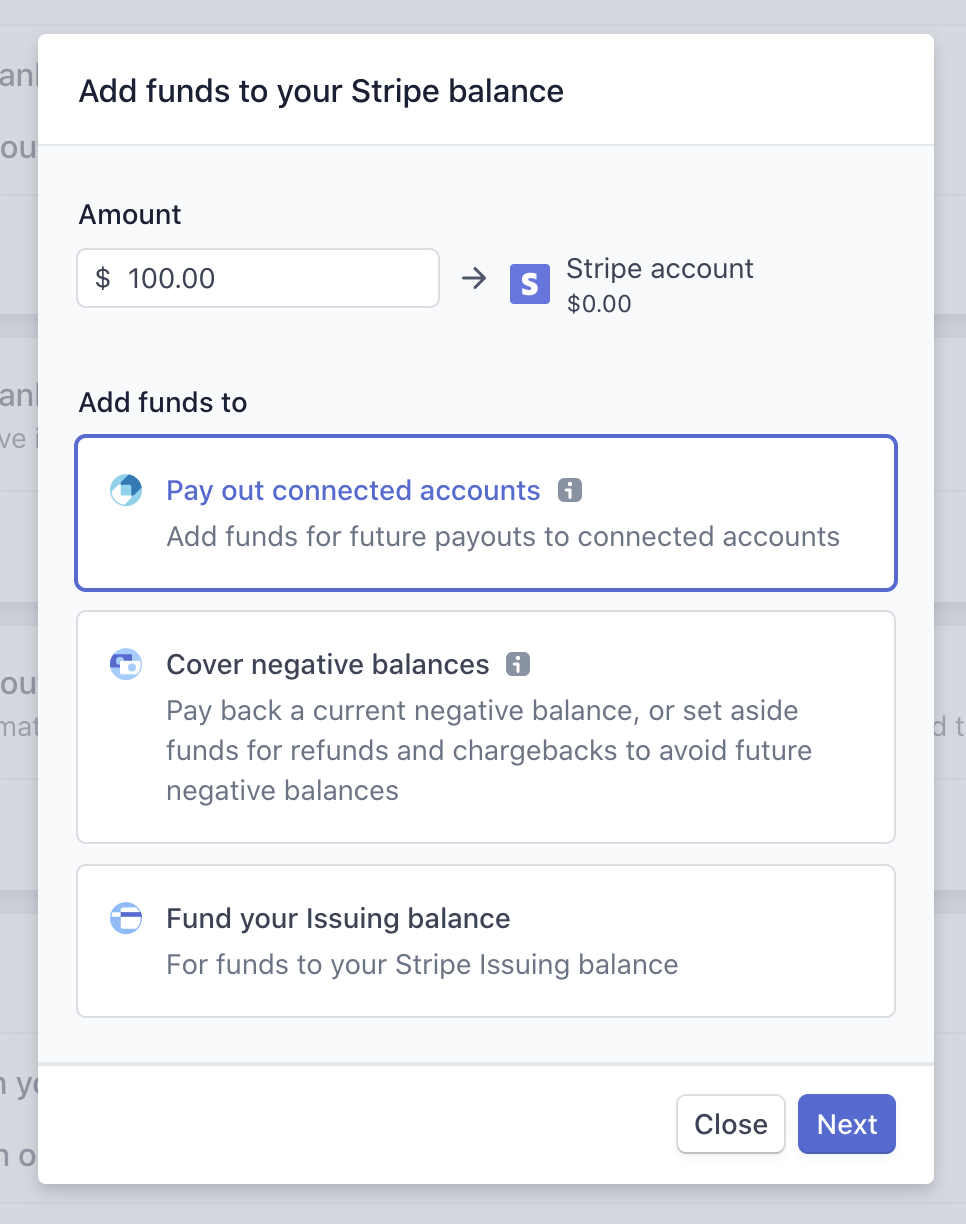

To add funds, go to the Balance section in the Dashboard. Click Add to balance and select why you are adding funds to your account.

Select Pay out connected accounts to add funds to pay out to your connected accounts. If you are adding funds to your balance to cover future refunds and disputes, or to repay your platform's negative balance, select Cover negative balances and see adding funds to your Stripe balance.

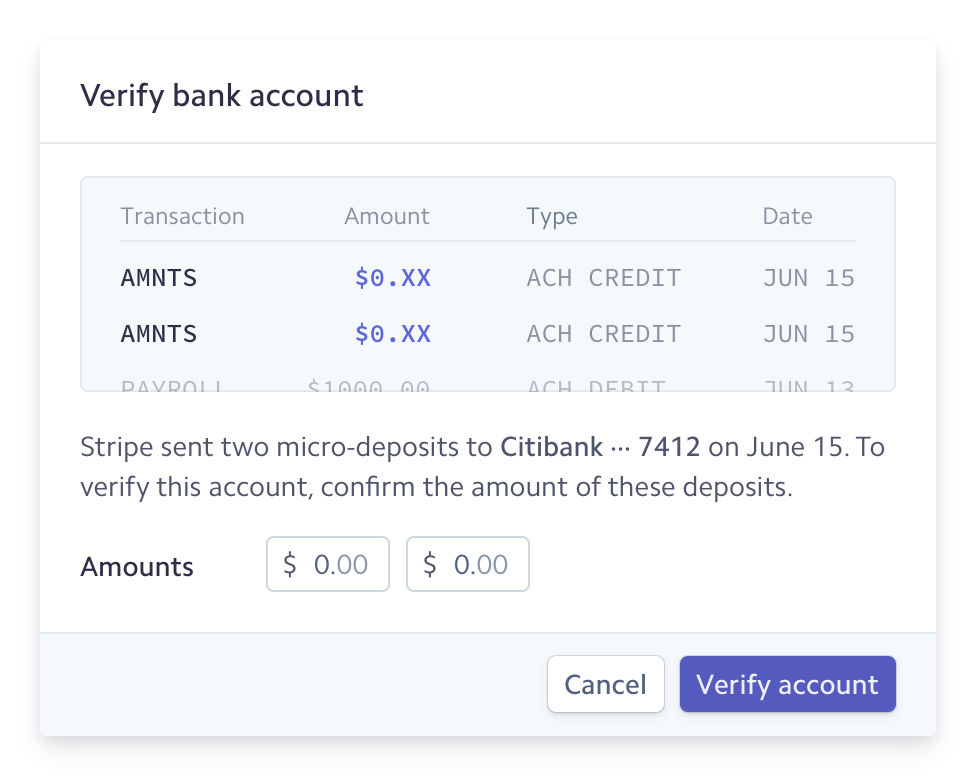

Verify your bank account

Go through the verification process in the Dashboard when you first attempt to add funds from an unverified bank account. If your bank account is unverified, you'll need to confirm two microdeposits from Stripe. These deposits appear in your online banking statement within 1-2 business days. You'll see AMTS as the statement description and the values of the two microdeposits.

Stripe notifies you in the Dashboard and through email when the microdeposits have arrived in your account. To complete the verification process, click the Dashboard notification in the Balance section, enter the two microdeposit amounts, and click Verify account.

Create a top-up

Once verified, create a top-up to add funds to your account balance.

curl https://api.stripe.com/v1/topups \ -u: \ -d amount=2000 \ -d currency=usd \ -d description= "Top-up for week of May 31" \ -d statement_descriptor= "Weekly top-up"sk_test_4eC39HqLyjWDarjtT1zdp7dc

When you transfer funds, a statement descriptor appears on your banking statement for the transaction. The default statement descriptor is Top-up. You can customize the statement descriptor and internal description for the top-up.

View funds

View your funds in the Dashboard on Top-ups tab under the Balance page. Each time you add funds, a top-up object is made that has a unique ID in the format tu_XXXXXX, which you can see on the detailed view for the top-up.

Settlement timing

US platforms add funds via ACH debit and can take 5-6 business days to become available in your Stripe balance. You can request a review of your account for faster settlement timing in the Dashboard.

As we learn more about your account, Stripe might be able to decrease your settlement timing automatically.

Adding funds for future refunds and disputes or to repay a negative balance can happen through bank or wire transfers and are available in 1-2 business days.

You can transfer available funds to a connected account using the API. For example, make the following call to transfer 10 USD to an account:

curl https://api.stripe.com/v1/transfers \ -u: \ -d amount = 1000 \ -d currency = "usd" \ -d destination = "{{CONNECTED_STRIPE_ACCOUNT_ID}}"sk_test_4eC39HqLyjWDarjtT1zdp7dc

By default, any funds that you transfer to a connected account accumulates in the connected account's Stripe balance and is paid out on a daily rolling basis. You can change the payout schedule as needed.

From your account Dashboard, you can view an account and its balance.

Use the test bank tokens to simulate flows for accounts and onboarding, payouts, and adding funds.

How to Transfer Money From Stripe to Bank Account

Source: https://stripe.com/docs/connect/add-and-pay-out-guide

0 Response to "How to Transfer Money From Stripe to Bank Account"

Post a Comment